Become a NYSE Investor for $1

Hey, y’all, let me tell you upfront, we both win! If you’ve made it this far, you’re interested in investing your spare or not-so-spare change into something that will grow faster than the (overshadowed by inflation) interest rates of a savings account with your bank or credit union. Because money kept in a savings account is gaining the national average 0.13% rate of savings accounts. Inflation over the past thirty years has been averaging 2.30%. That said, in a savings account, your $100 is growing to $100.13 next year… But wait, that same $100 is only worth $97.70 next year. If you haven’t put that together, continue to live in bliss and transfer away! Otherwise, keep up this read and just learn a bit! Reading doesn’t make you do a thing but learn.

Overcoming the fear of loss

There is overwhelming volatility in the stock market! That is a known fact. Also, a known fact, considerable risk brings big reward. On that note… You’re not willing to put your hard-earned dollars in a risky position. If I told you to set a twenty-dollar bill into a paper shredder, but it might not turn on, that 0.13% looks pretty safe, huh? You have to realize that the fear we have in investing is the play that everyone we’ve encountered has in the market. The ups and downs, the horror stories, and the incredible 600% gains overnight, that we’re never a part of. That’s not investing. That’s playing and either winning or losing. I’m not talking about playing! I’m talking about investing! It’s safe, it’s predictable, it’s reliable! If you know what you’re looking for. It’s effortless. In comes the ETF

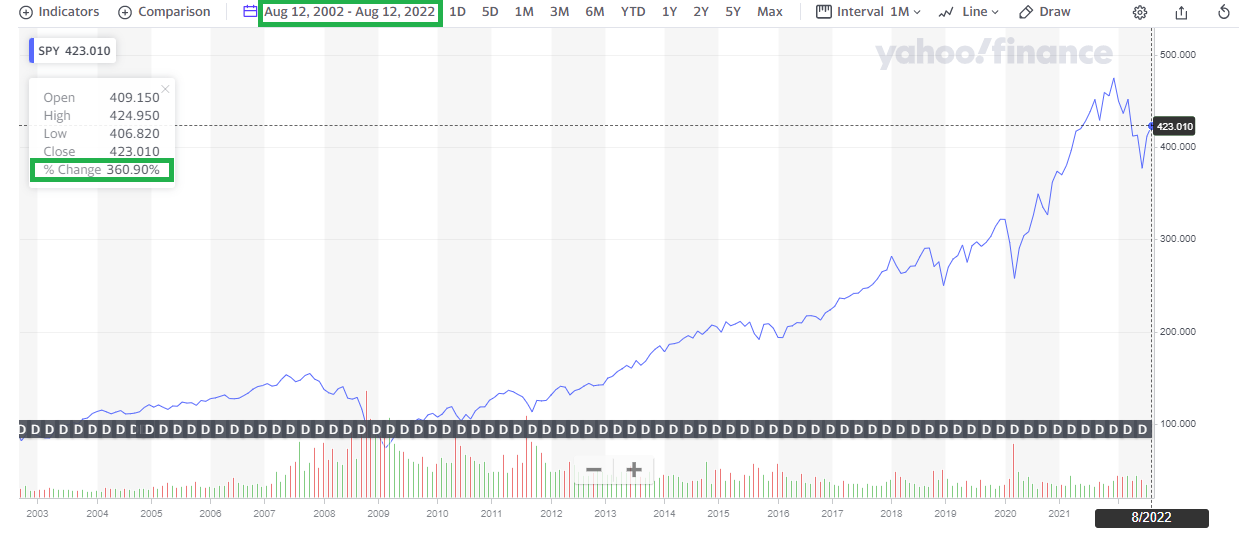

If you check out that chart briefly, you’ll see the 20-year growth of the SPDR S&P 500 ETF Trust. Exponential growth! a 20-year career (We’re talking long-term investing here. $100 turns into $360.31. According to THIS spectacular compound interest calculator that’ll do all the work for you, The S&P 500 has an average return of 6.6% annually. Obviously, there are years of loss. But with dedication and ignoring it. You are absolutely guaranteed to gain over time. You don’t have to manage your money. Sell at optimal times; buy at optimal times. You need only consistently contribute to your account and maintain a solid portfolio of reliable companies and ETFs, which is a guaranteed win.

Intimidation Tactics

The NYSE, investing kingpins, and masters of industry keep the idea of investing intimidating! P/E Ratio, PEG, NASDAQ, DOW, bid, ask, yield, volume, beta, r-squared, endless terms that anyone would be deterred by after glancing. But, the good news is, in long-term investing, none of that matters. Especially when looking at ETFs, Let’s use S&P, for example. It’s a fund composition of the exchange’s 500 most prominent and reputable companies. Ultimately they have holdings in each company, and their funds are disseminated amongst those companies. The reliable aspect of the ETF is if Apple goes under tomorrow and takes an absurd amount of blowback in the media and just tanks… They immediately fall out of the S&P 500 and are replaced by another reliable company. So you’re not along for the ride; that is their attempt to climb back out of that storm.

SPY costs $423?! I don’t have that lying around!

You’re wrong! You do have shares of SPY lying around. Because the great thing about the Robinhood trading platform is they have recently incorporated ETFs into their partial share trading feature! They have in-depth articles and updated news on each ticker on the exchange, not to mention crypto and less known companies! So for as little as $1.00, you can grow your money. On top of that, if you’re not already on Robinhood. You’ll receive a free stock from the links to their platform found in this article ! Which you can sell and buy some more SPY!

I’m Already On Robinhood

Great! There are ETFs for every sector in the market; there are ETFs compiled of robotics companies, Artificial Intelligence Companies, Commodities, anything you have faith in, look into it! Get on there and at least monitor that ETF, and also, please, research.

I will leave you with this note… NEVER buy a stock. You’re buying a part of a company! Know what you’re buying, read about the company, its missions, concepts, and morals, and understand what you’re getting into.

This barely brushes the surface, but more will come! Comments welcome to improve or expound on subjects!

Related Articles

Choosing Bread for Your Health Goals: Processed vs. Fresh Bread and Its Impact on Calorie Management

New Paragraph