To Invest or Not to Invest?

I’d say most Americans are not suited for investments. At the same time, many avenues are available like Robinhood, WeBull, Seeking Alpha, and Investopedia. There are endless resources available. But that’s not the point. The point is debt! Americans live in debt. What is debt? Let’s tackle that before we move on.

What Is Debt?

Debt is anything that you’ve borrowed for. Your mortgage, vehicle payments, part of your phone bill, credit cards, consumer loans, payment plans, all of it! It’s all forms of debt! When you borrow, look at it like you’re borrowing against your later self. So, you’re borrowing now to get things now that you’re going to pay off in the future. Whereas saving is putting money away for your future self. Which sounds better?

How To Evaluate Debt

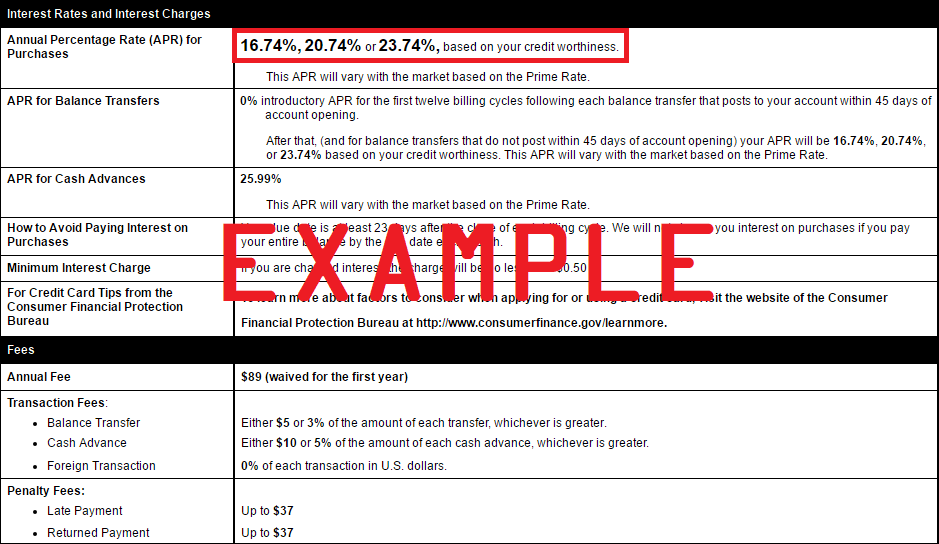

When evaluating your debt, you should already have a spreadsheet or financial management app to know your spending habits, saving habits, debt, etc. Check out this article on where to get that checked off. Once you have that going for you and you’ve already pulled yourself out of the state of bliss, you were living in paying off minimum monthly credit card payments. Let’s see the nitty gritty. Look at APRs; for most consumer debt (Credit Cards), it’s anywhere from twelve percent to some cases, as much as twenty-six percent. If you’ve been borrowing religiously for the past five years or decade, you’re probably on a lower rate from your bank, depending on how you’ve handled it. Expect big numbers. We’ll go off the national average, according to Lending Tree , 20.82%.

What Does That Mean for Me?

Down to the core, APR is like Compound Interest and ROI. If you’re ROI doesn’t supersede your APR on a credit card… You’re losing by investing your money because all those capital gains from your hard work go directly to the credit cards. Essentially, you’re fighting fire with gasoline. So, if you carry an outstanding balance with your credit cards month to month, it would be futile and make no sense to invest your “Extra money” to potential exponential gains in the stock market or any other investment.

Don’t Get Me Wrong

Financial Investments are the key to financial security in the future. Not participating in high volatility stocks is imperative unless you are fully invested (Not financially, attentively). You are required to fully invest your time and attention into maintaining reliable positions, observing companies’ financials, monitoring their performance, and reading news on the movements of a company. It’s all very demanding. However, investing to gain compound returns is effortless. Read more here. So, don’t be demotivated by all the moving parts and factors into financial security! You’re almost there! Knowing is half the battle; the following steps are the easiest. Evaluate your finances, obtain a reasonable goal date to be out of debt, and most importantly, don’t get back into debt. Use these simple tips & tricks to use credit cards positively.

Conclusion

Get after it! I strongly recommend using Excel as it does all the math for you or even google sheets (it’s free). If you need help getting that started, please reach out to me, and I’d be happy to sit down and have a one-on-one walkthrough to get it going! I want you to succeed, and hopefully, you’ll come back and leave a comment that I helped at all! Happy spending and happier savings!

Related Articles

Choosing Bread for Your Health Goals: Processed vs. Fresh Bread and Its Impact on Calorie Management

New Paragraph